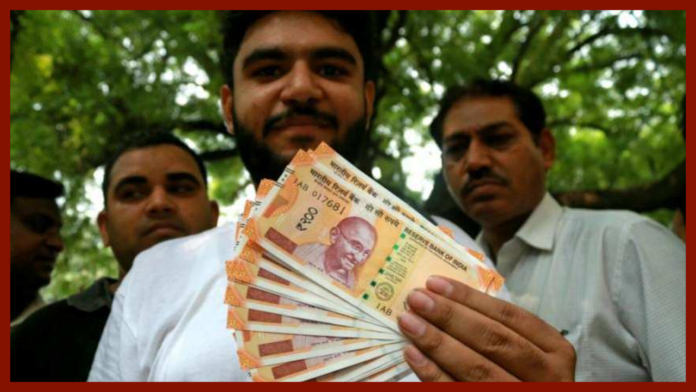

Jan Dhan Yojana: If you are also a Jan Dhan account holder then this news is for you. Actually, let us tell you that even if you have zero balance in your Prime Minister Jan Dhan account, you will get ten thousand rupees. Let us tell you that earlier the overdraft limit was Rs 5,000. This was later doubled to Rs 10,000…

PM Jan Dhan Yojana: Pradhan Mantri Jan Dhan Yojana is the national mission for financial inclusion. These include financial services like savings and deposit accounts, credit, insurance, pension etc. Under Pradhan Mantri Jan Dhan Yojana, individuals who do not have any other account can open a Basic Savings Bank Deposit (BSBD) account in any bank branch or Business Correspondent (Bank Mitra) outlet.

At the same time, account holders also get another facility of Rs 10,000 in PM Jan Dhan account. Actually, account holders of Pradhan Mantri Jan Dhan Yojana are eligible for overdraft (OD) or credit facility up to Rs 10,000 in this zero-balance account.

Pradhan Mantri Jan Dhan Yojana-

Earlier the overdraft limit was Rs 5,000. This was later doubled to Rs 10,000. This means that if any account holder needs an overdraft of Rs 10,000 in his account even if he has zero balance, under this scheme such persons who do not have any other account can go to any bank branch or Business Correspondent (Bank Mitra). ) One can open a Basic Savings Bank Deposit (BSBD) account in the outlet. At the same time, account holders in PM Jan Dhan account also get another facility of Rs 10,000.

PM Jan Dhan Yojana –

The general objective of this facility is to provide hassle free loans to low income group/disadvantaged customers to meet their exigencies without insisting on security, purpose or end use of credit. Basically overdraft means that the bank allows customers to borrow a certain amount of money. Interest is charged on the loan. And usually fees are paid per overdraft.

These persons can avail the benefit of overdraft of Rs 10,000

- BSBD accounts, which have been operated satisfactorily for at least six months.

- Overdraft will be given to the earning member of the family or the women of the house.

- Must have regular credit under DBT/DBTL scheme/other verifiable sources.

- Account should be linked to Aadhaar to avoid duplicate benefits.

- The BSBD account holder should not maintain any other SB account with any bank/branch to ensure compliance with RBI instructions.

- Applicant’s age should be between 18 years to 65 years

- The period for sanction of overdraft is 36 months subject to annual review of the account.