CBDT Update: Recently many such cases have come to the fore in which the tax department is rejecting the exemption claimed by taxpayers under the Income Tax Act while filing IT returns.

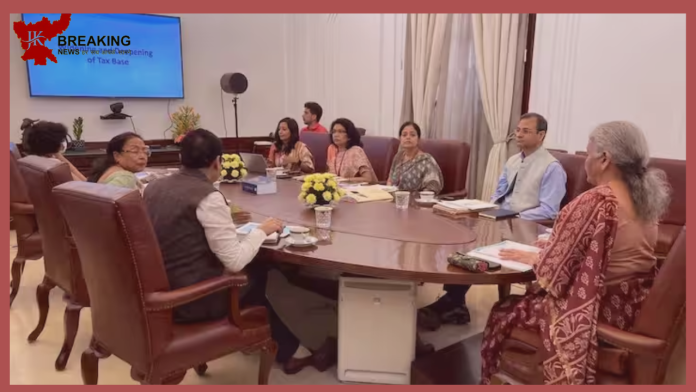

Nirmala Sitharaman: Finance Nirmala Sitharaman held a review meeting with the Central Board of Trustees (CBDT) to deliberate on how to increase the number of taxpayers in the country, in which the Revenue Secretary as well as the CBDT chairman and members of the CBDT attended. In the meeting, the Finance Minister was informed about the steps taken by the Income Tax Department. In the meeting, the Finance Minister insisted on taking immediate action on the applications filed by the taxpayers from the CBDT and taking all necessary action on them, as well as processing and disposing of these applications within a reasonable time limit.

In the meeting held by the Finance Minister with the CBDT, three points were discussed. In which how to increase the number of taxpayers. Second, cases of pending disciplinary action against Income Tax officials and third, disposal of applications for condonation of delay and grant of exemption under the Income Tax 1961 Act.

Union Finance Minister Smt. @nsitharaman chairs review meeting with Central Board of Direct Taxes @IncomeTaxIndia in New Delhi today 👇

Read more ➡️ https://t.co/uuJbt9D4IY pic.twitter.com/UvGoBY8EWK

— Ministry of Finance (@FinMinIndia) April 25, 2023

In the review meeting, the Finance Minister was told that there has been a jump of 1118 per cent in the information to be reported due to new sources of data on dividends, interest, shares, mutual funds and financial transactions from GSTN. Due to this, information about 3 crore additional people has been received.

In 8 years, the new TDS code has increased from 36 to 65, due to which only 70 crore transactions were reported in 2015-16, whose number has increased to 144 crore. Due to this, the number of unique deductees has increased from 4.8 crore in 2015-15 to 9.2 crore. The Finance Minister was informed that the contribution of personal income tax to GDP has increased from 2.11 per cent to 2.94 per cent in 2014-15.

In this meeting, the Finance Minister reviewed the ongoing disciplinary action against the employees and officers of Income Tax and asked to minimize the procedural delay in the action. The Finance Minister directed the CBDT to expeditiously finalize such proceedings. The Finance Minister emphasized that the CBDT should ensure timely and proper processing of all applications filed by taxpayers and called for a reasonable time frame for disposal of such applications.